Gain Insight. Automate Valuation. Manage Risk.

In the insurance industry, accurate and timely property data is critical to managing risk exposure, setting fair premiums, and ensuring adequate coverage. At Arvio, we help insurers and risk-focused institutions streamline property valuation, integrate ESG insights, and automate damage identification — all with minimal operational burden.

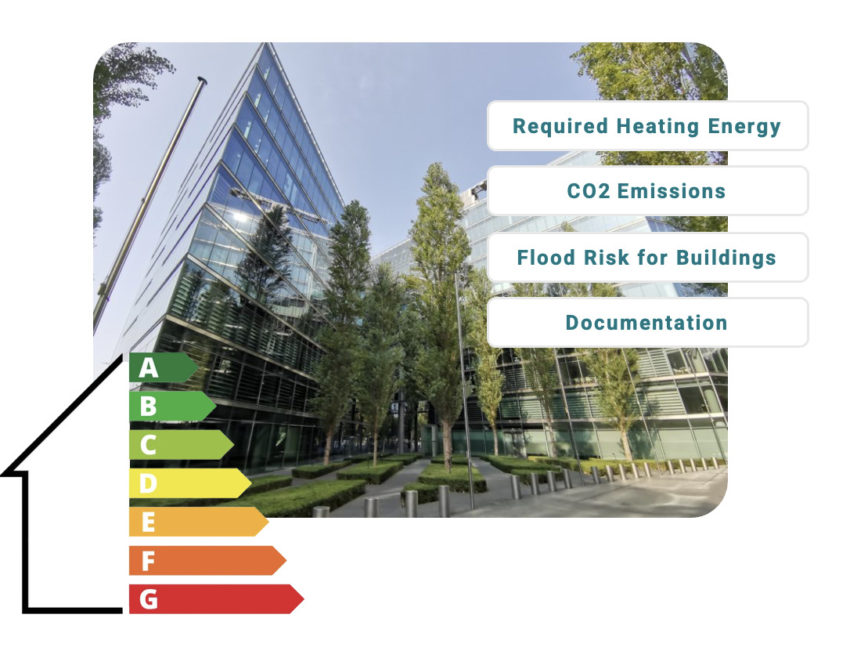

Integrating ESG in Insurance Strategies

As ESG standards gain traction, compliance will soon be mandatory for companies of all sizes. Properties not meeting these standards may incur higher financing costs, comparable to the difference between prime and subprime investments.

Advanced Predictive Modeling

Arvio’s predictive model assesses energy efficiency and flood risk, offering crucial insights for aligning with ESG requirements. This tool evaluates key factors like energy class and CO2 emissions, aiding insurance companies in strategic decision-making.

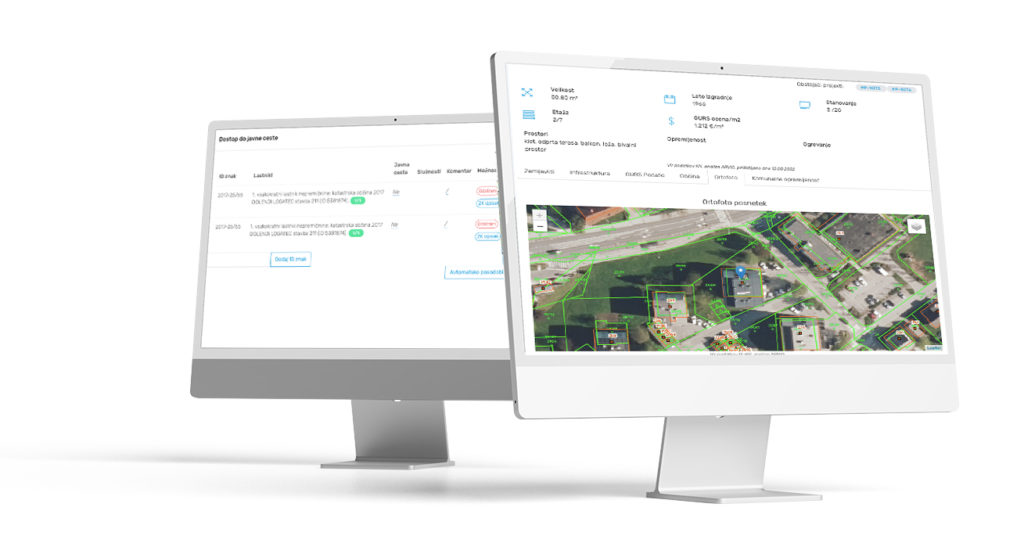

Solutions in Action: See What We Deliver for Insurance & Risk Companies

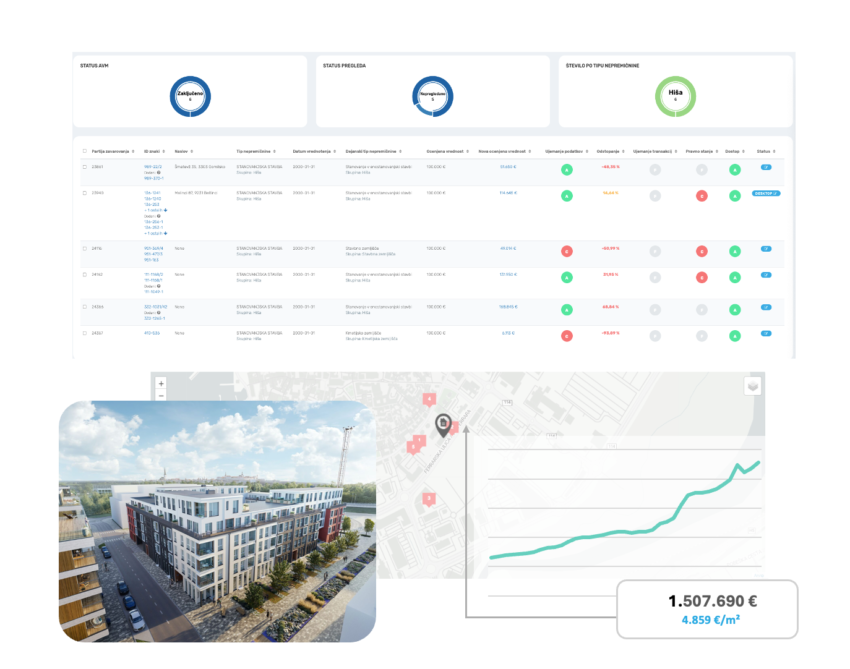

With Arvio, you gain access to powerful tools that help reduce uncertainty, standardize underwriting, and automate risk evaluation workflows.

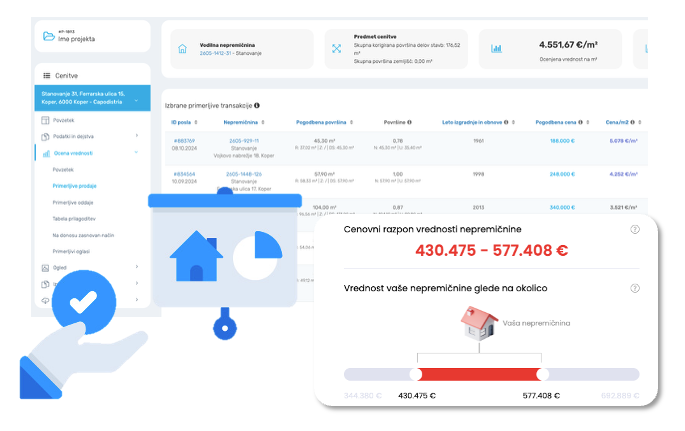

Portfolio Valuation for Insurance

ESG Risk Evaluation for Property Portfolios

On-Demand Property Valuation Reports

AI-Based Damage Identification from Images

Collateral Monitoring and Revaluation

Why Leading Banks Trust Arvio

Specialized Real Estate Expertise

Validated Statistical Models

Seamless Integration

Continuous Monitoring

ESG and Regulation-Ready

Proven Use in Insurance Workflows

Customer Stories

Z.T.

Risk Manager at a Bank

Ž.P.

Real Estate Appraiser

S.P.

Real Estate Agent and Analyst

Looking for a Customized Consultation?

We are ready to discuss our solutions in detail and assist in selecting the most suitable product for your requirements.