Empowering Banks to Modernize Mortgage Processes

In today’s competitive landscape, banks face mounting pressure to deliver faster, more transparent, and fully digital mortgage experiences – while maintaining operational efficiency, minimizing risks, and meeting evolving regulatory requirements.

At Arvio, we specialize in developing advanced, practical solutions tailored to modern banking challenges.

Solutions in Action: See What We Deliver for Banks

Explore examples of how Arvio’s solutions help banks transform their mortgage, collateral, and risk management workflows.

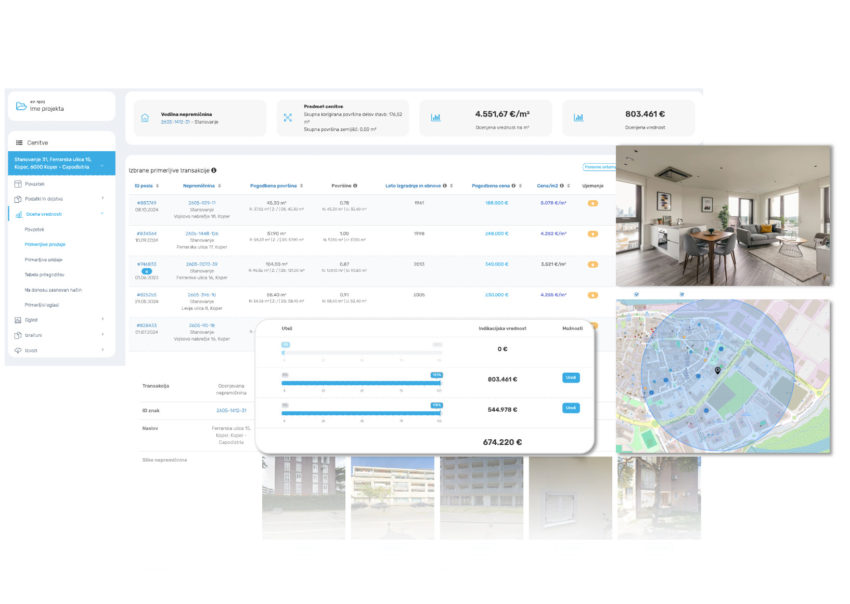

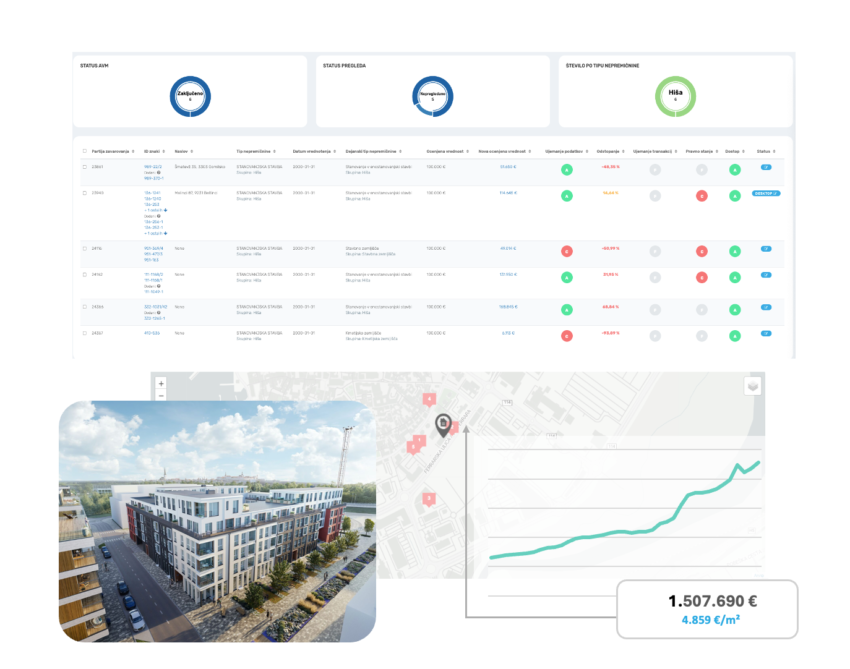

Portfolio Valuation Optimization

Streamlining large-scale real estate portfolio valuations with AVM technology.

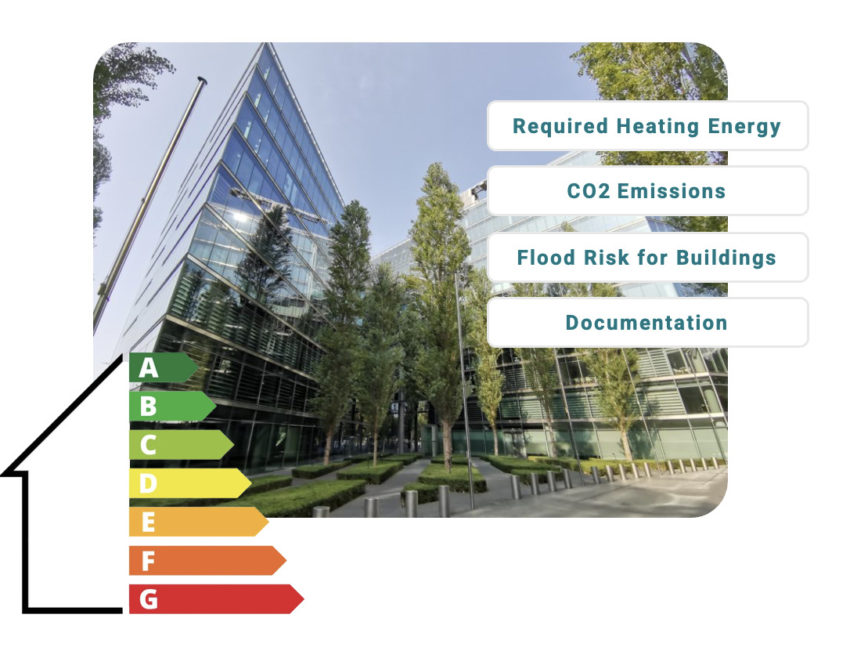

Access Detailed Case Study ESG Risk Assessment for Property Portfolios

Integrating environmental risk factors into property evaluation and credit decisions.

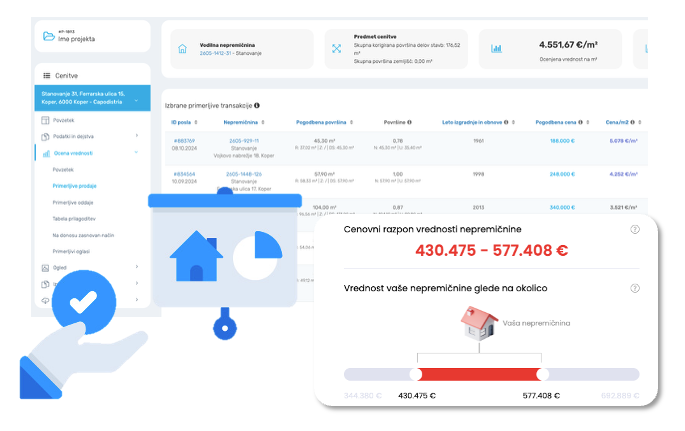

Access Detailed Case Study On-Demand Property Valuation Insights

Providing instant indicative valuations to support faster mortgage pre-approvals.

Access Detailed Case Study Mortgage Process Optimization

Automating collateral insurance checks and revaluations for faster processing.

Access Detailed Case Study Mortgage Approval Process Digitalization

Accelerating mortgage pre-approvals with fully digitalized customer onboarding.

Access Detailed Case Study Energy Certificate Data Access

Supplying banks with real-time energy efficiency data to support ESG compliance and lending policies.

Access Detailed Case Study Individual Property Valuations

Delivering accurate, standardized valuations for individual properties on demand.

Access Detailed Case Study Collateral Monitoring and Revaluation

Enabling ongoing collateral monitoring with automated risk triggers and portfolio updates.

Access Detailed Case Study Why Leading Banks Trust Arvio

Deep Banking Expertise

We understand mortgage workflows, credit risk processes, and regulatory frameworks — not just technology.

Proven Success with Financial Institutions

Our solutions have been successfully deployed across leading banks and financial institutions in Slovenia.

Minimal Disruption to Core Systems

Our modular approach ensures rapid deployment with minimal changes to your existing IT architecture.

Regulatory Compliance Built-In

All our models and integrations are designed with local and international compliance requirements in mind — including ESG factors.

Long-Term Partnership Approach

We work alongside your teams — from first workshop to post-implementation support — ensuring sustainable impact and continuous improvement.

Externally Validated Models

Our AVM and risk assessment models undergo external validation to meet the highest standards of transparency and reliability.

Customer Stories

Z.T.

Risk Manager at a Bank

As a risk manager at a bank, I faced the challenge of revaluing a portfolio of thousands of properties in just a few months. Due to the tight deadline and the need for individual appraisals for each property, I was seeking alternative solutions. Arvio proved to be a reliable partner with its unique Portfolio valuation product on the market.

Ž.P.

Real Estate Appraiser

In my reports, I regularly use the AMAS application to present spatial and legal data on the property being appraised, as well as data from location analysis and market supply analysis. I use it to present data on comparable transactions (sales and rentals) and to select comparable transactions.

S.P.

Real Estate Agent and Analyst

With every new project, I first turn to the ARVIO platform. I can't imagine assessing market conditions and estimating the most likely sale price of a property without accessing closed transactions. Without this application, it would be truly difficult to suggest an optimal listing price to sellers or to advise buyers on whether a purchase is favorable. Every client should be making decisions based on data rather than hearsay from neighbors or acquaintances.

Looking for a Customized Consultation?

We are ready to discuss our solutions in detail and assist in selecting the most suitable product for your requirements.