Strategic Solutions for Informed Investment Decisions

Access to precise property data is crucial for evaluating potential investments, optimizing development strategies, and maximizing long-term returns. Arvio empowers investors with accurate market insights, robust valuation models, and data-driven portfolio tools to support strategic decisions at every stage.

Key Challenges We Solve:

How Arvio Supports Informed Real Estate Investments

From initial market research to ongoing portfolio monitoring, Arvio provides real estate investors with reliable data, predictive analytics, and valuation solutions to support every stage of the investment process.

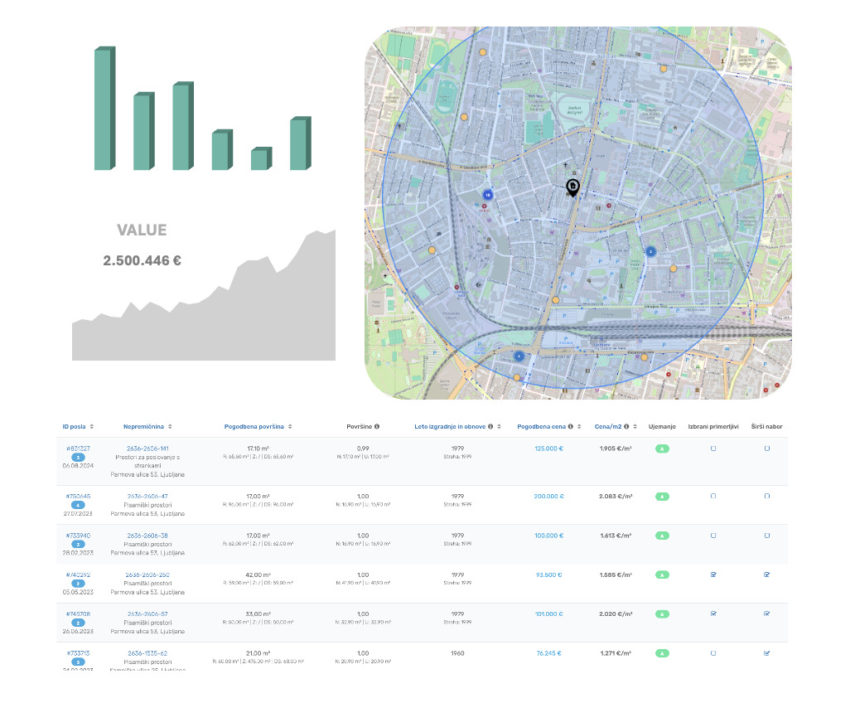

Portfolio Valuation Tools

Evaluate real estate portfolios using advanced AVM models to benchmark value and track performance.

Access Detailed Case Study Market Analysis & Insights

Identify local price dynamics, supply trends, and investment opportunities based on data-driven reports.

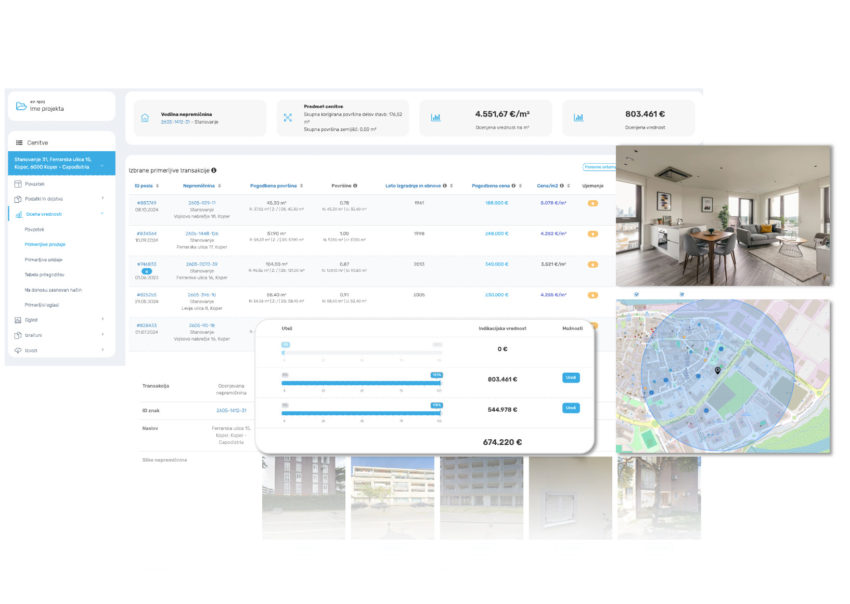

Access Detailed Case Study Individual Property Valuation

Access fast, objective valuations for individual properties to support buy/sell decisions.

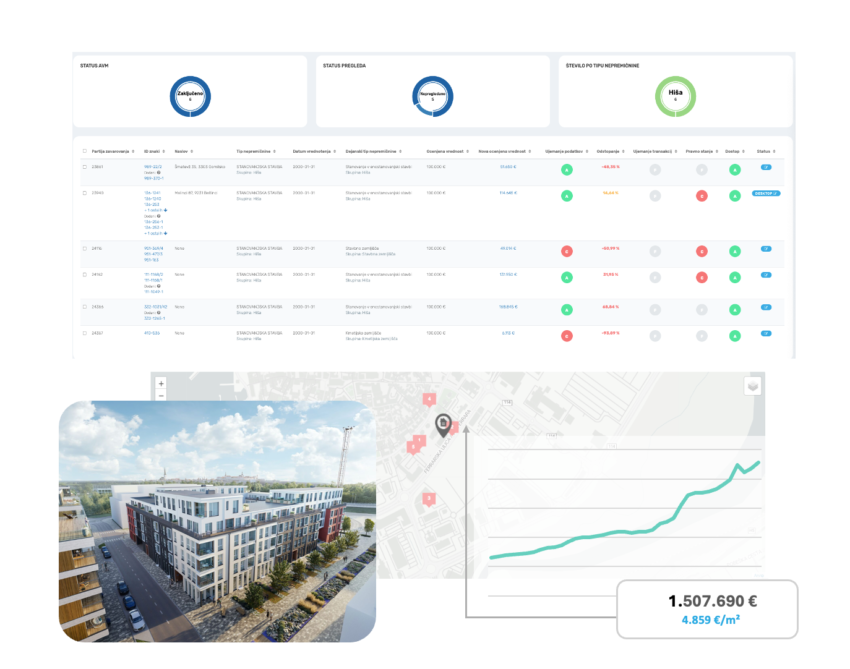

Access Detailed Case Study Long-Term Asset Monitoring

Use automated alerts and revaluation triggers to monitor investment performance over time.

Access Detailed Case Study Why Real Estate Investors Trust Arvio

Domain Expertise in Property Data

We understand valuation methodology, investment decision-making, and local market specifics.

Reliable and Validated Models

Our statistical models are internally and externally tested, ensuring robust and repeatable results.

Strategic Perspective

Our tools are designed to support investment decisions — from acquisition through management to exit.

Integration with Investor Workflows

Receive structured reports or integrate our data into your existing analytics tools.

ESG Awareness

We provide access to energy, location, and sustainability indicators to help guide responsible investment.

Consistent Monitoring

Track changes in value and risk throughout the lifecycle of your assets with minimal manual effort.

Customer Stories

Z.T.

Risk Manager at a Bank

As a risk manager at a bank, I faced the challenge of revaluing a portfolio of thousands of properties in just a few months. Due to the tight deadline and the need for individual appraisals for each property, I was seeking alternative solutions. Arvio proved to be a reliable partner with its unique Portfolio valuation product on the market.

Ž.P.

Real Estate Appraiser

In my reports, I regularly use the AMAS application to present spatial and legal data on the property being appraised, as well as data from location analysis and market supply analysis. I use it to present data on comparable transactions (sales and rentals) and to select comparable transactions.

S.P.

Real Estate Agent and Analyst

With every new project, I first turn to the ARVIO platform. I can't imagine assessing market conditions and estimating the most likely sale price of a property without accessing closed transactions. Without this application, it would be truly difficult to suggest an optimal listing price to sellers or to advise buyers on whether a purchase is favorable. Every client should be making decisions based on data rather than hearsay from neighbors or acquaintances.

Looking for a Customized Consultation?

We are ready to discuss our solutions in detail and assist in selecting the most suitable product for your requirements.